WEEKLY FINANCIAL MARKET REPORT AS OF 16TH AUGUST 2024

KEY HEADLINES

Government of Ghana misses Treasury Bill auction target for five consecutive weeks.

With a target value of $20 million, the Bulk Oil Distribution Companies (BDCs) Forward Rates auction ended with a rate of GHS 15.73. (Bank of Ghana, 2024).

Ghana Government Advances Transparency and Environmental Integrity in Clean Stove Carbon Finance. (Ghana Carbon Market Office, 2024)

PRIMARY DEBT MARKET ISSUANCE WEEK

The Government of Ghana’s Treasury bills displayed minimal fluctuations in their yields over the recent period. The 91-day GoG bill showed a slight increase from 24.8251% to 24.8435%, while the 182-day GoG bill similarly increased from 26.7642% to 26.7469%. In contrast, the 364-day GoG bill experienced a marginal decline from 27.8575% to 27.8509%.

| Security | Current % | Previous % |

| 91-Day GoG Bill |

24.8435 |

24.8251 |

| 182-Day GoG Bill |

26.7469 |

26.7642 |

| 364-Day GoG Bill |

27.8509 |

27.8575 |

Source(s): Bank of Ghana

These minor fluctuations imply that the short-term interest rate environment is relatively stable, which means that investors are still inclined to maintain an interest in the government’s short-term debt instruments. Government has targeted an amount of GHS 5.3 billion through the issuance of the 91-day, 182-day, and 364-day Treasury Bills for the next auction this coming week.

For the tender conducted on July 12, government missed its target of GH¢4.72 billion as total bids amounted to GH¢4.4 billion. For the auction conducted on July 19, government again missed its target of GH¢5.3 billion against a total tender of GH¢3.87 billion. The situation was no different for the auction conducted on July 26, as government raised GH¢4.06 billion against a target of GH¢4.77 billion. For the auction conducted on August 2, the targeted amount fell short by over GH¢560 million as government raised GH¢3.80 billion against a target of GH¢4.36 billion. In the previous auction week on August 9, the government again missed its target of GH¢6.55 billion when it raised only GH¢5.30 billion, a shortfall of over GH¢1 million.

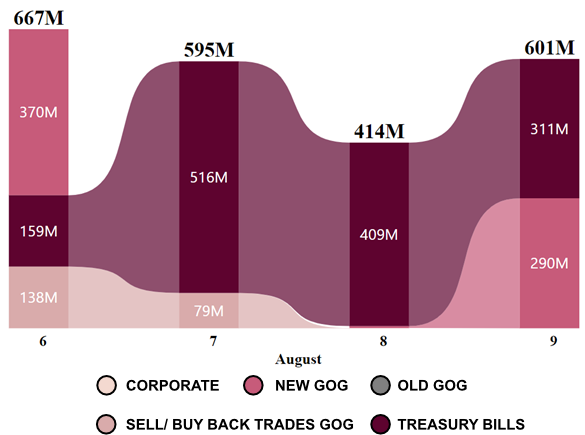

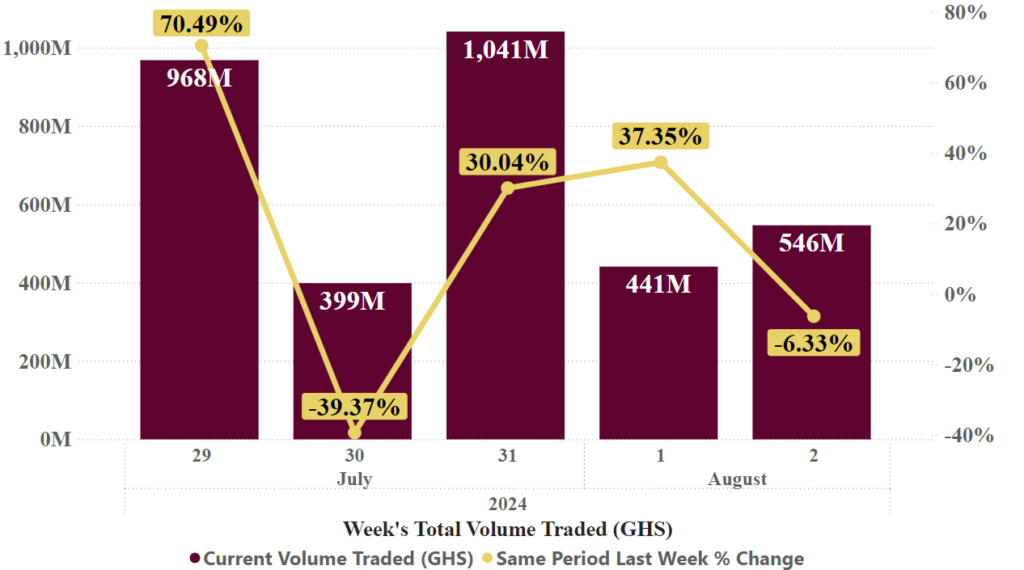

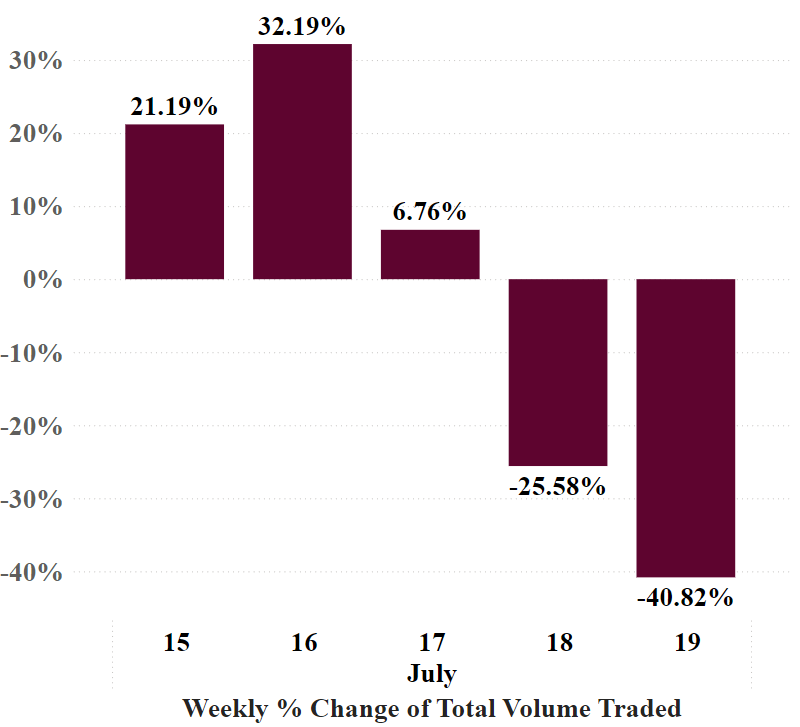

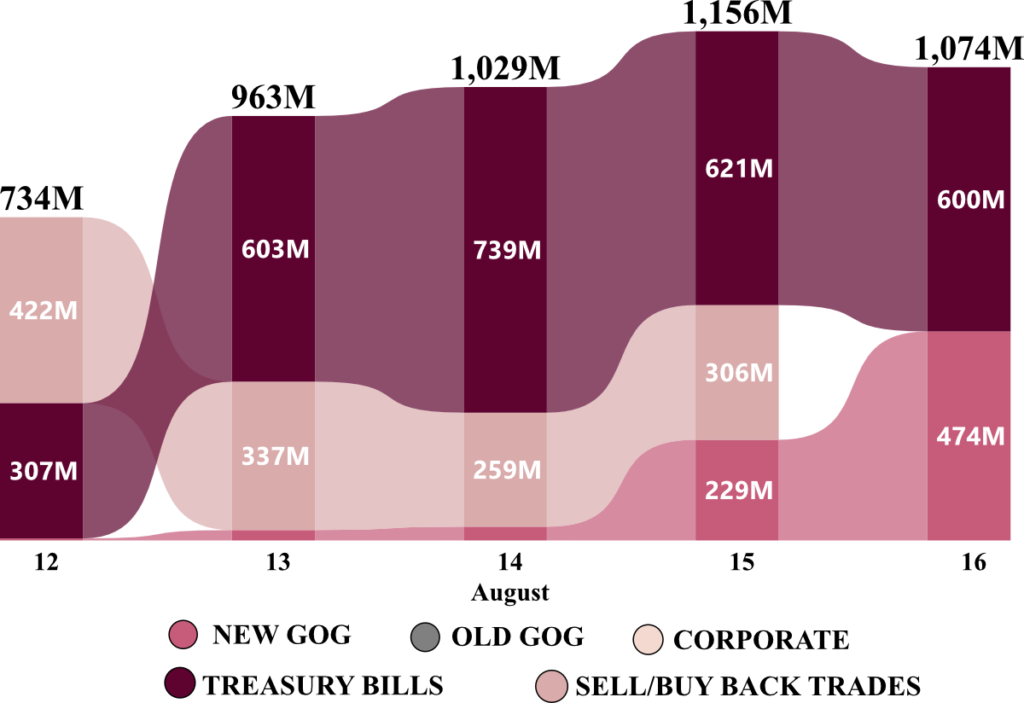

GHANA FIXED INCOME MARKET VOLUME TRADED

The Ghana Fixed Income Market closed the week with a total volume traded of GHS 4.96 billion. A total of 6,158 trades were made of which 97.92% were Treasury bills, and 1.66% were New GoG Notes & Bonds.

On August 12, the total traded volume was GHS 734 million, with GHS 307 million in Treasury Bills and GHS 422 million in Sell/Buy Back Trades (GOG Notes & Bonds), making them the dominant instruments for the day. The market saw significant movement on August 13, with the total volume increasing to GHS 963 million. The largest contributions came from Treasury Bills at GHS 603 million and Sell/ Buy Back Trades, GHS 337 million.

Week’s Ghana Fixed Income Market Total Volume Traded

The peak trading activity occurred on August 15, with a total volume of GHS 1,156 million. This day saw Treasury Bills leading the market again with GHS 621 million in volume, followed by Sell/Buy Back Trades at GHS 306 million and New GOG bonds at GHS 229 million. On August 16, the market slightly declined but remained robust with a total volume of GHS 1,074 million. Treasury Bills continued to dominate at GHS 600 million, while New GOG bonds contributed GHS 474 million in volume.

Throughout the week, Treasury Bills consistently held the largest share of the total volume traded, indicating strong investor appetite for the short-term government securities. The interest in the Sell/Buy Back Trades and New GOG bonds also suggests a diversification of investment strategies among market participants.

EQUITY MARKET

This week’s trading on the local bourse concluded with a total of 17,883,651 shares exchanging hands, valued at GHS 113,161,405.85, lifting the market capitalisation to GHS 92.78 billion.

The stock market saw notable movements, with Unilever Ghana PLC (UNIL) leading the charge. UNIL’s share price increased by GHS 1.23, closing at GHS 16.00, marking a significant gain. Followed by, Guinness Ghana Breweries PLC (GGBL) increased by GHS 0.46, closing at GHS 5.16. On the other hand, NewGold (GLD) was the week’s underperformer, with its share price falling by GHS 1.56 to end the week at GHS 366.24.

Regarding market indices, the GSE Composite Index (GSE-CI) settled at 4,440.53, reflecting a weekly contraction of 0.006%, though it remains up 5.83% for the month and an impressive 41.86% year-to-date. Meanwhile, the GSE Financial Stocks Index (GSE-FSI) ended at 2,122.83 points, recording a monthly gain of 1.87% and a year-to-date return of 11.64%.

| EQUITY MARKET MOST TRADED STOCKS | ||

|

Ticker |

Traded Volume |

Price (GHS) |

| MTNGH | 17,024,118 | 2.27 |

| FML | 315,163 | 3.50 |

| GGBL | 103,456 | 5.16 |

| EGL | 79,859 | 1.65 |

| CAL | 55,625 | 0.34 |

Source(s): Ghana Stock Exchange

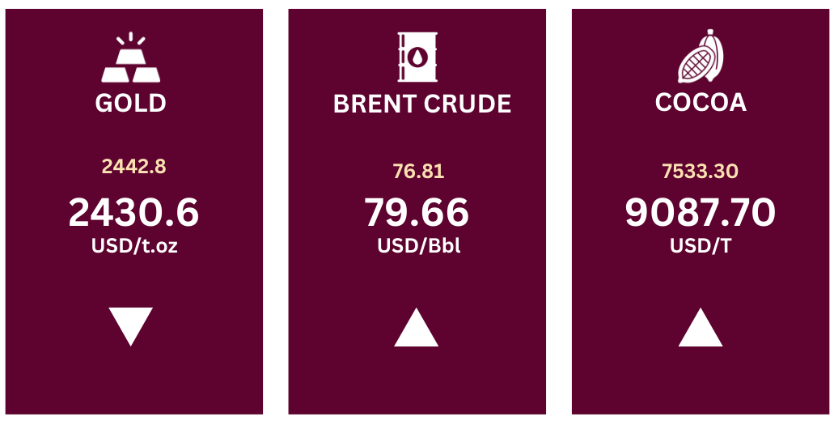

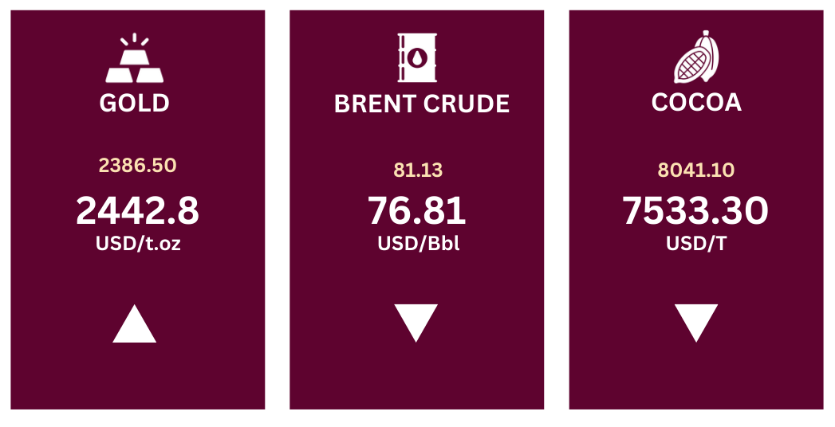

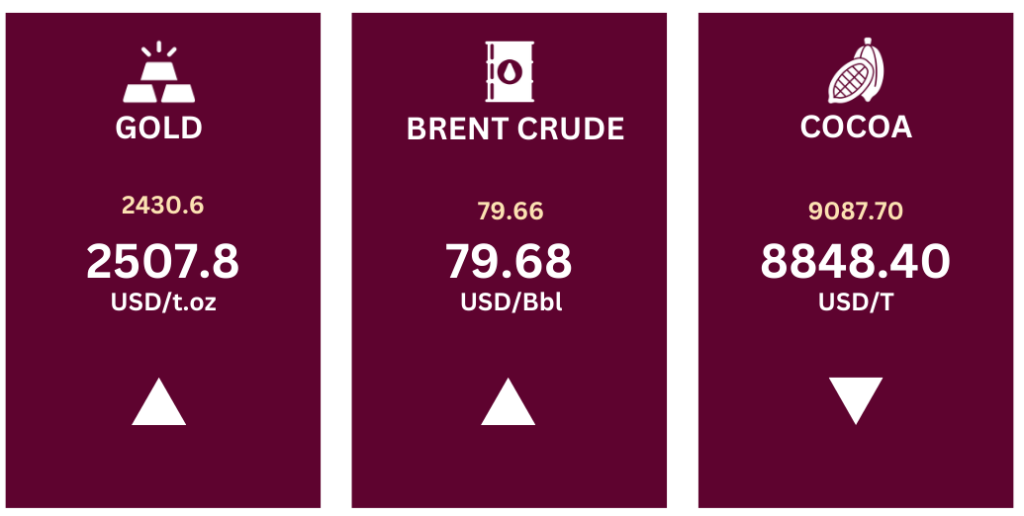

COMMODITY MARKET

The commodities market exhibited mixed performance this week. Gold prices rose from US$ 2,430.6 to US$ 2,507.8 per troy ounce. Despite a broad consensus that the US Federal Reserve will implement 100 basis points in rate cuts over their three remaining meetings this year, strong retail sales data has led investors to scale back expectations for a more aggressive 50 basis point cut next month.

Brent crude prices witnessed a slight increase, moving from US$ 79.66 to US$ 79.68 per barrel, amid reports that Qatar urged Iran to ease tensions with Israel during ongoing Gaza cease-fire negotiations. The dip in oil prices from a quarterly high of US$ 87.20 per barrel on July 3 also reflects broader concerns about declining demand from China, the world’s largest oil importer. Recent Chinese economic data highlighted slowing growth, falling home prices, and rising unemployment, which prompted Chinese refineries to cut crude processing rates.

Source(s): Trading Economics

Similarly, cocoa prices declined from US$ 9,087.70 to US$ 8,848.40 per ton, staying near their highest levels since mid-June. Dealers pointed out that inventories remain tight due to a record deficit in the 2023/24 season. However, they expect a potential global surplus in the 2024/25 season, driven by a more favourable crop outlook in West Africa.

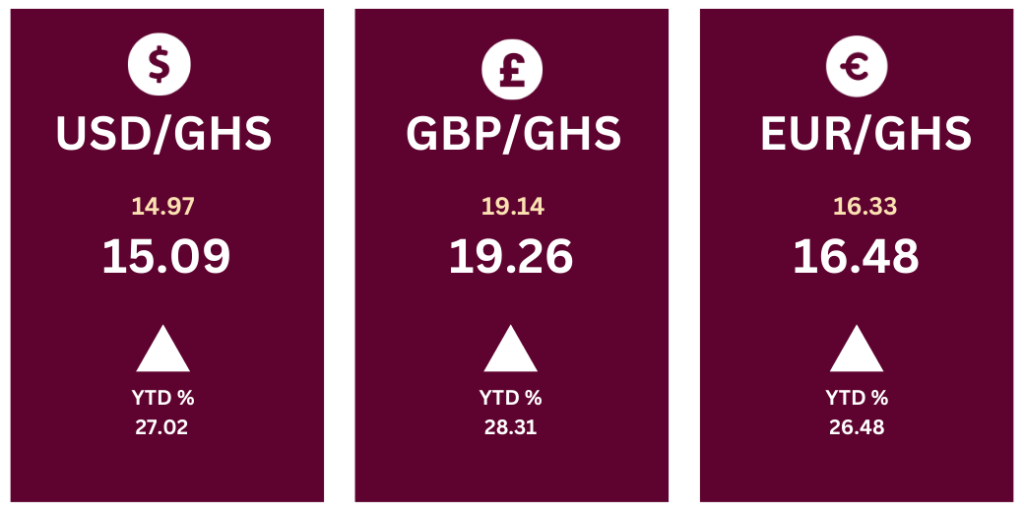

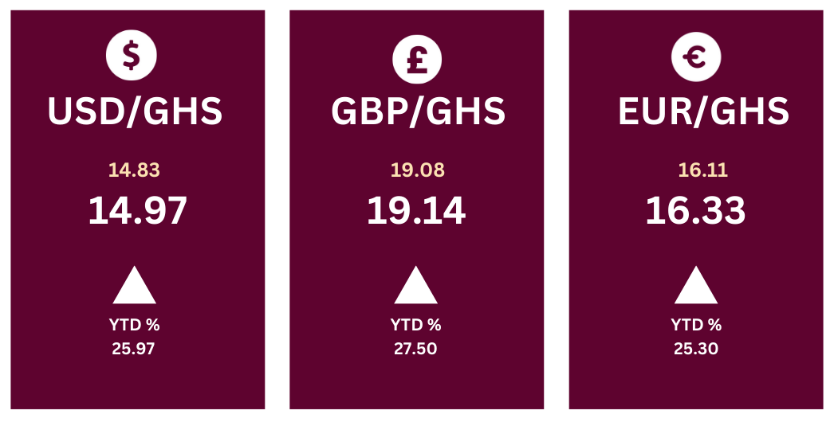

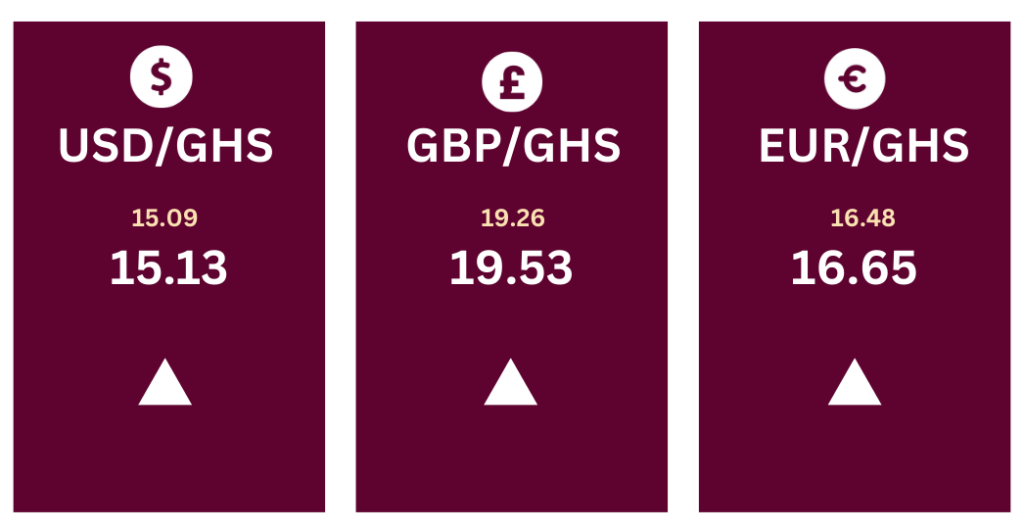

CURRENCY MARKET

The Ghana cedi continued its depreciation against major foreign currencies, with the exchange rates showing an upward trend; fueling higher import costs and inflationary pressures. The USD/GHS rate increased from GHS 15.09 to GHS 15.13, the GBP/GHS rate rose from GHS 19.26 to GHS 19.53, and the EUR/GHS rate also climbed from GHS 16.48 to GHS 16.65.

Source(s): Bank of Ghana

Source(s): Bank of Ghana

DISCLAIMER: The information contained in this weekly update on the financial markets is intended for informational purposes only and should not be construed as financial, investment or other professional advice. The data are derived from internal and external sources that FFC Research finds reliable. FFC Research assumes no responsibility or liability for any actions taken based on the information contained in this report.

Research Analyst – Cedric Asante | Email: cedric.asante@firstfinancecompany.com