WEEKLY FINANCIAL MARKET REPORT AS OF 2ND AUGUST 2024

KEY HEADLINES

Bank of Ghana Launches Centralized Foreign Exchange Trading Platform to Enhance Financial Integrity and Oversight. (Bank of Ghana, 2024)

The Bank of Ghana has announced the results of the recent Forex Forward Rates Auction for Bulk Oil Distribution Companies (BDCs). The auction concluded with a forward rate of GHS15.5647 per US Dollar, successfully meeting the target amount of US$20 million. (BDC Forex Forward Rates, 2024)

Ghana’s Voluntary Carbon Market has retired 7,902.62 kilotonnes (kt) of carbon credits through household projects and 704 kt through Natural and Biological Systems projects as of May 30, 2024 (West African Climate Alliance, 2024)

MTN Ghana announces interim dividend amid strong half-year performance for 2024. (Ghana Stock Exchange, 2024)

PRIMARY DEBT MARKET ISSUANCE WEEK

In the latest update, the yields on Government of Ghana (GoG) Treasury Bills exhibited modest upticks across all tenors. The yield on the 91-Day GoG Bill increased slightly from 24.7880% to 24.8246%. Similarly, the 182-Day GoG Bill yield edged up from 26.7414% to 26.7641%. The 364-Day GoG Bill also saw a marginal rise from 27.8563% to 27.8578%.

| Security | Current % | Previous % |

| 91-Day GoG Bill | 24.8246 | 24.7880 |

| 182-Day GoG Bill | 26.7641 | 26.7414 |

| 364-Day GoG Bill | 27.8578 | 27.8563 |

Source(s): Bank of Ghana

For the upcoming auction for the week, Government has set a target amount of GH¢ 6,557.42 million from the issuance of the 91-Day, 182-Day, and 364-Day Treasury Bills.

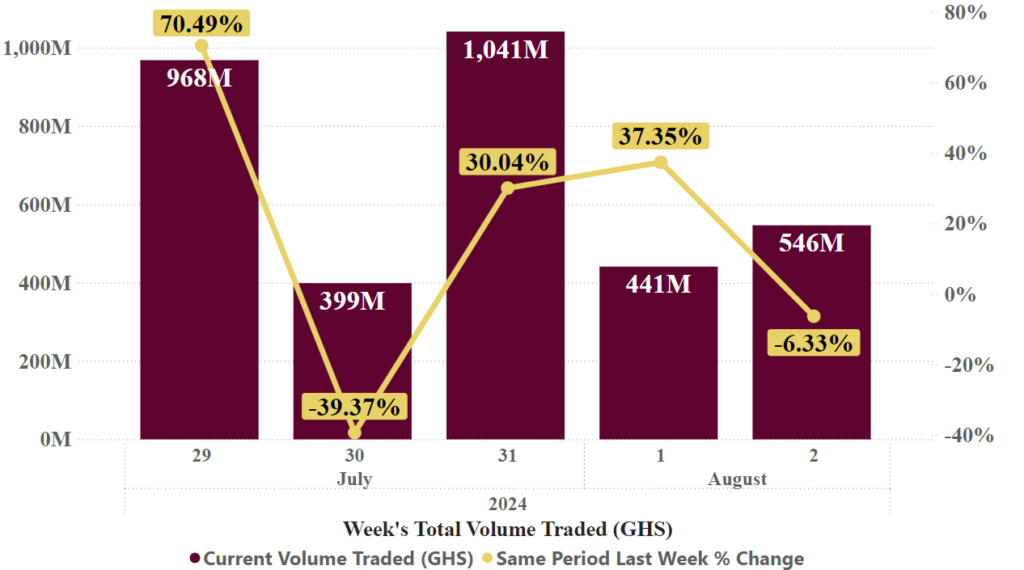

GHANA FIXED INCOME MARKET VOLUME TRADED

Compared to the previous week, the total volume traded for the week recorded mixed outturns. The first trading day witnessed a substantial increase, with a volume of GHS 967,926,836, up 70.49%, alongside a significant DDEP trading volume of GHS 406,089,217. However, Tuesday experienced a sharp decline, with the volume traded falling to GHS 398,822,588, a 39.37% decrease, and no recorded DDEP trades.

The market rebounded on Wednesday recording the highest volume for the week at GHS 1,041,016,357, up 30.04%, as against the prior week. Thursday’s trading volume reached GHS 440,978,769, a 37.35% increase, with a modest DDEP volume of GHS 1,430,000.

The week’s trading activities concluded with Friday’s volume at GHS 546,443,699, down 6.33%. However, the DDEP volumes surged to GHS 298,192,254. Overall, the week was marked by high volatility, with significant daily variations in total volume traded compared to the previous week.

EQUITY MARKET

The week’s trading activities on the local bourse ended with a total traded volume of 735,157 shares valued at GHS 1,944,468.33, lifting the market capitalization to GHS 94.36 billion.

The stock market experienced substantial gains, with GCB Bank PLC (GCB) and Scancom PLC (MTNGH) dominating the trading activities for the week. GCB’s share price rose by GHS 0.30 to close at a price of GHS 5.90. In a similar vein, MTNGH witnessed a surge in its share price by GHS 0.07, closing the week at GHS 2.41 per share. No laggards were reported for this week, indicating a positive trend in the market.

On the GSE market indices, the GSE Composite Index (GSE-CI) added 96.10 points to close at 4,586.28, representing a weekly gain of 2.14%, a month gain of 16.09%, and an overall year-to-date gain of 46.52%. The GSE Financial Stocks Index (GSE-FSI), likewise, rose by 20.62 points to reach 2,115.52 points, a weekly gain of 0.98%, and a year-to-date return of 11.25% for investors.

| MOST TRADED STOCKS | ||

|

Ticker |

Traded Volume |

Price (GHS) |

| MTNGH | 453,869 | 2.41 |

| CAL | 110,350 | 0.34 |

| GCB | 102,372 | 5.90 |

| SIC | 20,446 | 0.25 |

| EGL | 13,136 | 1.55 |

Source(s): Ghana Stock Exchange

| TOP PERFORMING AFRICAN STOCK INDICES YEAR-TO-DATE | |||

|

Country |

Index |

Level |

YTD % |

| Ghana | GSE-CI | 4,586.28 | ▲46.52 |

| Zambia | LuSE ASI | 14,480.57 | ▲33.73 |

| Nigeria | NGSE ASI | 97,745.73 | ▲30.72 |

| Malawi | MSE ASI | 132,752.47 | ▲19.65 |

| Tanzania | DSE ASI | 110.03 | ▲18.07 |

Source(s): AFX Kwayisi, African Markets

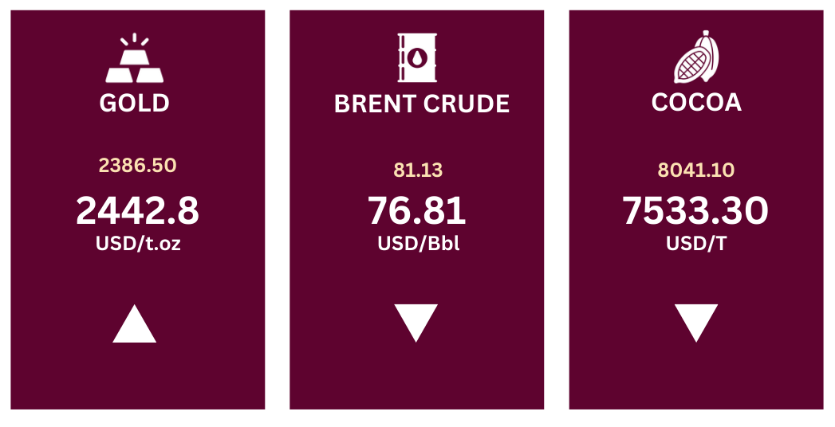

COMMODITY MARKET

The commodities market has shown varied performance. Gold prices have surged from US$ 2,386.50 to US$ 2,442.8 per troy ounce. In contrast, Brent Crude prices have declined from US$ 81.13 to US$ 76.81 per barrel of crude oil, Similarly, Cocoa prices dipped from US$ 8041.10 to US$ 7533.30 per ton. The rise in gold prices suggests increased demand or investor interest, while the declines in Brent Crude and Cocoa prices may indicate reduced demand.

Source(s): Trading Economics

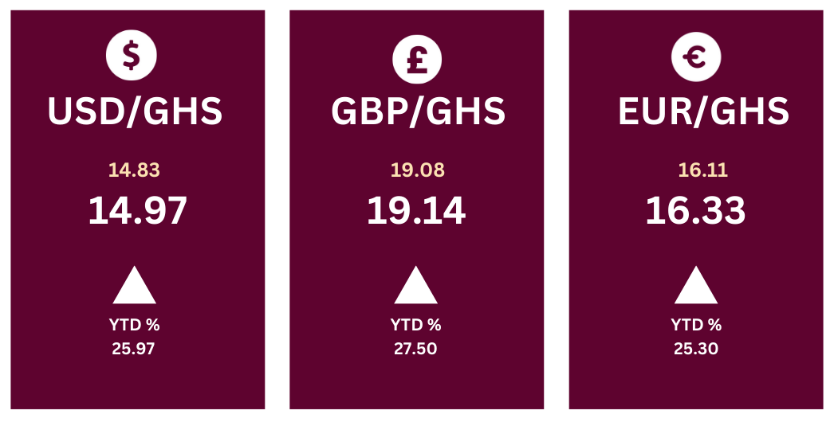

CURRENCY MARKET

The Ghanaian Cedi (GHS) has shown notable depreciation against major foreign currencies year-to-date (YTD). The exchange rate for USD/GHS has risen from GHS 14.83 (previous week) to 14.97, with a 25.97% gain to the dollar YTD. Similarly, GBP/GHS increased from GHS 19.08 (previous week) to 19.14, reflecting a 27.50% increase compared to the beginning of the year. The EUR/GHS exchange rate also climbed from GHS 16.11 (previous week) to GHS 16.33, indicating a 25.30% year-to-date gain for shared currency.

Source(s): Bank of Ghana

HIGHLIGHTS: GHANA’S CARBON CREDITS AND ECONOMIC POTENTIAL

- Ghana primarily operates within voluntary markets to promote clean energy production, reduce emissions, and foster sustainable initiatives.

- As of May 30th, 2024, retired 7,902.62 kilotonnes (kt) of carbon credits through household projects and 704 kt through Natural and Biological Systems projects (West African Climate Alliance, 2024).

- Economic Potential: Ghana could unlock $82 billion annually from carbon credits.

- Support: Efforts supported by the Ghana Stock Exchange and the Environmental Protection Agency to develop climate finance initiatives, aiding Ghana’s $562 billion transition plan.

UPCOMING EVENTS

Association Cambiste International (ACI) Ghana Financial Markets Conference 2024

Theme: Navigating the Future: Innovation, Ethical Excellence, and Inclusion in Ghana’s Financial Markets

Date: 22nd August 2024

Location: The Grand Arena, International Conference Centre

West African Energy Summit

Theme: Driving Global Finance, Deal Origination and Local Content in the West African Energy Sector.

Date: 3rd September, 2024 – 5th September, 2024

Location: Accra International Conference Centre