WEEKLY FINANCIAL MARKET REPORT AS AT 12TH JULY 2024

Overview

ECONOMIC REVIEW

Ghana’s GDP grew by 4.7% year-on-year in the first quarter of 2024, its strongest expansion since Q4 2021, rising from 3.8% in the previous quarter.

|

Index |

Current |

Previous |

Trend |

|

GDP Annual Growth Rate |

4.7% |

3.8% |

▲ |

|

Monetary Policy Rate |

29.0% |

29.0% |

– |

|

Inflation Rate |

22.8% |

23.1% |

▼ |

Source(s): GSS, BoG

Conversely, annual consumer inflation contracted for the third consecutive month, reaching 22.8% in June 2024, the lowest rate since March 2022, down from 23.1% in May 2024.

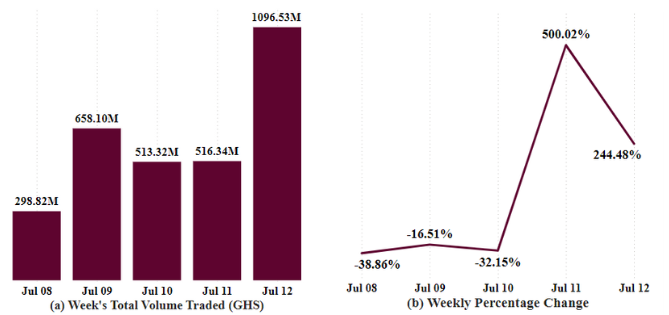

GHANA FIXED INCOME MARKET VOLUME TRADED

During the week, GFIM experienced noteworthy fluctuations in trading volumes. On Monday, trading volume was GHS 298.8 million, representing a 38.86% decline from the previous day. Volumes surged to GHS 658.1 million on Tuesday, then decreased mid-week, before peaking at GHS 1.1 billion as at July 12, 2024.

Notably, DDEP bond trading volumes were highest on Tuesday (GHS 363.9 million) and Friday (GHS 633.6 million), indicating

strong investor activity in these bonds despite overall market volatility.

GHANA STOCK EXCHANGE MARKET

The GSE-CI appreciated by 3.44% to 4,086.54 compared to 3,950.49 attained the previous week, boosting its YTD gain to 30.55% from 3,130.23. Meanwhile, the GSE Financial Index (GSE-FI) experienced a modest decline of 0.88%, ending at 2,083.94, though it still shows a YTD increase of 9.59% compared to 1,901.57 attained earlier. Despite a sharp 91.55% decrease in trading volume this week, market capitalization expanded by 2.27%.

|

Gainers |

Laggards |

||||

|

Ticker |

Price (GHS) |

Weekly Change |

Ticker |

Price (GHS) |

Weekly Change |

|

GLD |

359.52 |

6.62 |

EGL |

1.73 |

0.43 |

|

TOTAL |

12.37 |

0.82 |

|

||

|

BOPP |

23.00 |

0.99 |

|

||

|

ALLGH |

6.00 |

0.20 |

|

||

|

MTNGH |

2.01 |

0.11 |

|

||

Source: GSE

This week’s performance on the GSE saw significant gains led by GLD, which rose by 6.62, TOTAL and BOPP also saw modest increases of 0.82 and 0.99, respectively, reflecting stable demand in petroleum and positive sentiment in agriculture. ALLGH and MTNGH experienced slight upticks, indicating stable performance. Conversely, EGL was the main laggard, dropping by 0.43 to GHS 1.73 and has been on a downshift since 2nd July 2024.

|

MOST TRADED STOCKS |

||

|

Ticker |

Traded Volume |

Price (GHS) |

|

EGL |

1,469,054 |

1.37 |

|

MTNGH |

685,006 |

2.01 |

|

EGH |

116,253 |

6.10 |

|

SIC |

36,639 |

0.25 |

|

ALLGH |

26,871 |

6.00 |

Source(s): GSE

This week’s most traded stocks on the GSE were led by EGL with a traded volume of 1.47 million shares valued at GHS 1.37 per share, indicating strong investor interest. MTNGH followed with 685,006 shares traded, at the price of GHS 2.01 per share. EGH saw 116,253 shares traded for GHS 6.10, showing significant activity. SIC and ALLGH had lower volumes of 36,639 and 26,871 shares, valued at GHS 0.25 and GHS 6.00 respectively per share, reflecting moderate trading interest.

|

SELECTED AFRICAN STOCK INDICES |

|||

|

Country |

Index |

Level |

YTD % |

|

Nigeria |

NGSE ASI |

99,671.28 |

▲33.30 |

|

South Africa |

JSE ASI |

81,686.49 |

▲6.23 |

|

Kenya |

NSE ASI |

110.03 |

▲19.45 |

|

Botswana |

BSE-DCI |

9,380.40 |

▲5.05 |

Source(s): AFX Kwayisi, African Markets

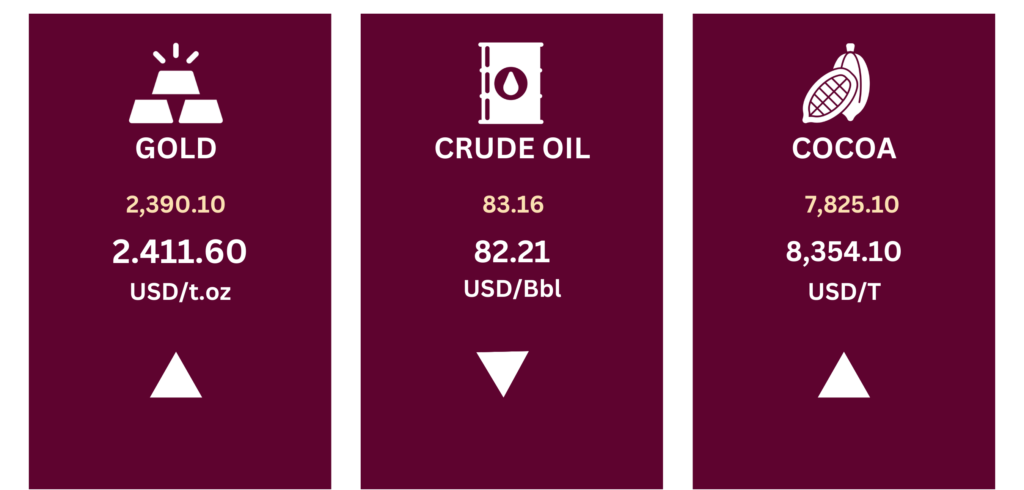

COMMODITY MARKET

As at July 12, Gold increased to $2,411.60 per ounce from $2.390.10, crude oil decreased from $83.16 per barrel to $82.21, and cocoa increased to $8,354.10 from $7,825.10 from the previous week.

Source(s): Trading Economics

The rise in cocoa prices could be largely attributed to a global shortage caused by climate change-induced droughts that have devastated crops in West Africa, which produces about 80% of the world’s cocoa (JP Morgan Research, 2024).

|

CURRENCY EXCHANGE |

|||

|

Exchange |

Current |

Previous |

YTD % |

|

USD/GHS |

14.7172 |

14.6707 |

▼19.32 |

|

GBP/GHS |

19.1096 |

18.7844 |

▼22.00 |

|

EUR/GHS |

16.0457 |

15.8833 |

▼18.98 |

Source(s): BoG

PRIMARY DEBT MARKET ISSUANCE WEEK

Treasury bill rates have remained consistent with last week’s figures across all maturities. The 91-day bill stood at 24.7899%, the 182-day at 26.7468%, and the 364-day bill at 27.7880%, indicating a stable market for short-term government securities compared the previous week.

|

Security |

Current % |

Previous % |

|

91-Day GoG Bill |

24.7899 |

24.7899 |

|

182-Day GoG Bill |

26.7468 |

26.7468 |

|

364-Day GoG Bill |

27.7880 |

27.7879 |

Source(s): BoG